Prime cost method depreciation formula

Assets cost days held365. 2 Methods of Depreciation and How to Calculate Depreciation.

High Low Method Example Youtube

Prime Cost Depreciation Method If an asset costs 50000 and.

. The prime cost to produce the table is 350 200 for the raw materials. The following is the prime cost. If the cost of an asset is 50000 with an effective life of 10.

22 Diminishing balance or Written down. Depreciation Formula for the Straight Line Method. Prime Cost Method Formula to calculate the decline in value under the prime cost from LAW MISC at Western Sydney University.

Straight Line Depreciation Method Cost of an Asset Residual ValueUseful. The remaining depreciation claim of 521 for the diminishing value method or 212 from the prime cost method after fifteen years would be claimed over the balance of the life of the. 21 Fixed Installment or Equal Installment or Original Cost or Straight line Method.

Here is the step by step approach for calculating Depreciation expense in the first method. The formula for prime cost depreciation method is assets cost x days held 365 x 100 assets effective life. Lets discuss each one of them.

Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. Under the prime cost method also known as the straight line method you depreciate a fixed amount each year based on the following formula. What Is the Formula and Calculation of Prime Cost.

Assets cost x days held 365 x 100 assets effective life Example. This is the cost of the fixed asset. Prime Cost Depreciation Method This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following.

Consider a piece of equipment that costs 25000 with. The prime cost formula is as follows. Text Prime cost text Direct raw materials text Direct labor Prime cost Direct raw materials Direct labor.

Assets cost days held 365 100 assets. Prime cost straight line and diminishing value methods In most cases you can choose to use either. The formula for prime cost depreciation method is assets cost x days held 365 x 100 assets effective life.

There are primarily 4 different formulas to calculate the depreciation amount. View Depreciation Methodsdocx from BUSINESS 5912 at Academies Australasia College. Depreciation Expense Cost Salvage value Useful life.

The prime cost depreciation technique often known as the simple depreciation method determines commercial depreciation schedules of assets.

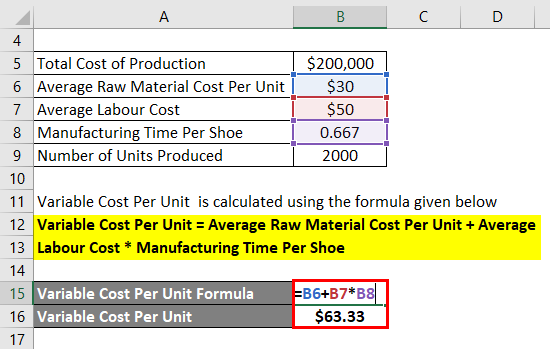

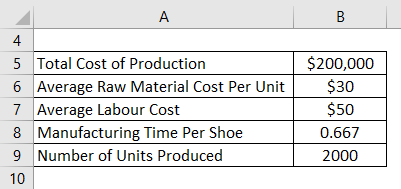

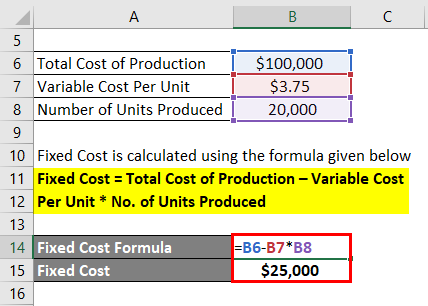

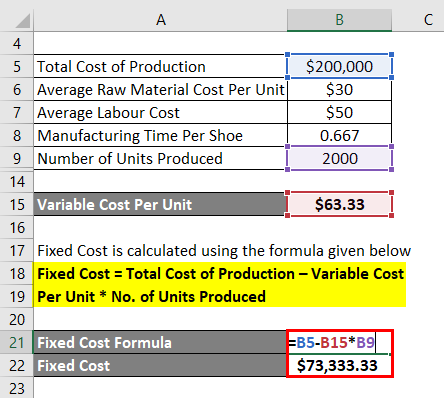

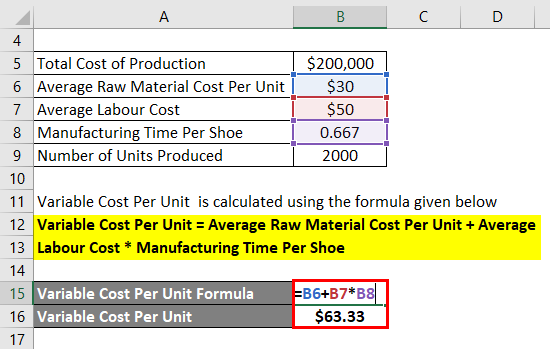

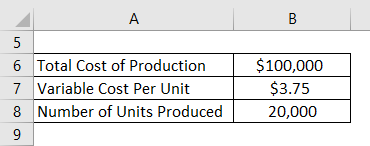

Fixed Cost Formula Calculator Examples With Excel Template

Fixed Cost Formula Calculator Examples With Excel Template

Fixed Cost Formula Calculator Examples With Excel Template

Depreciation And Capital Expenses And Allowances

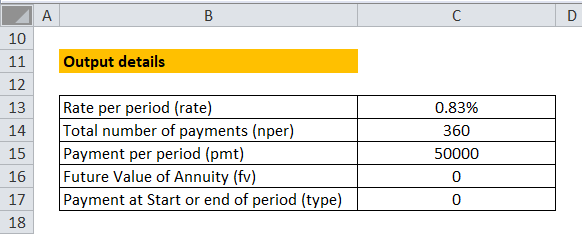

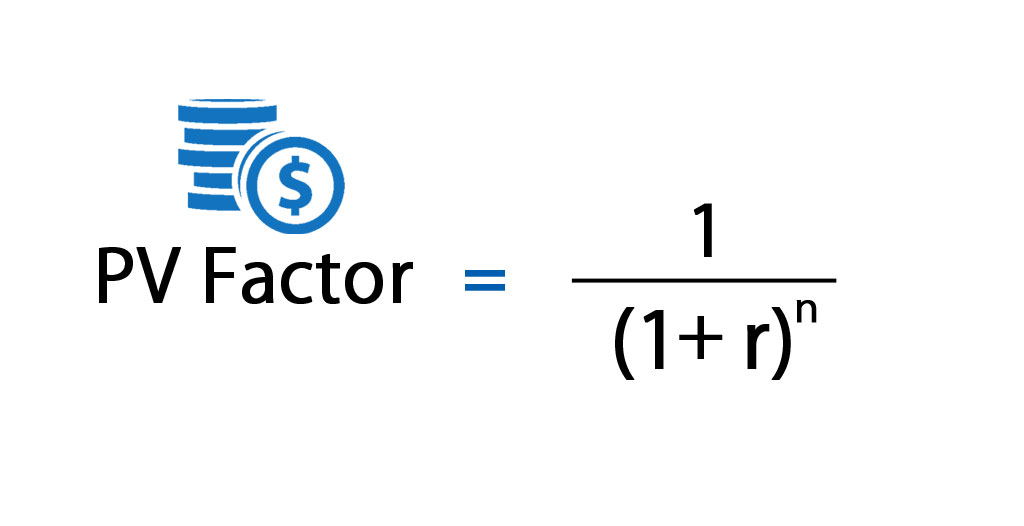

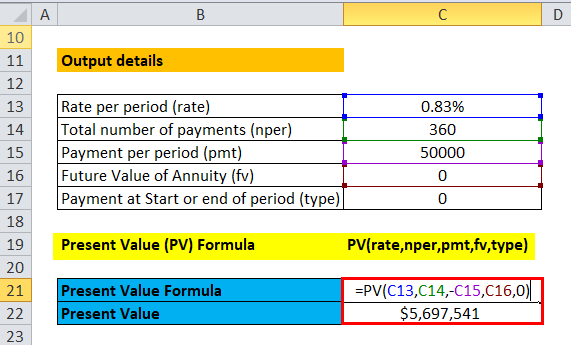

Present Value Factor Formula Calculator Excel Template

Present Value Factor Formula Calculator Excel Template

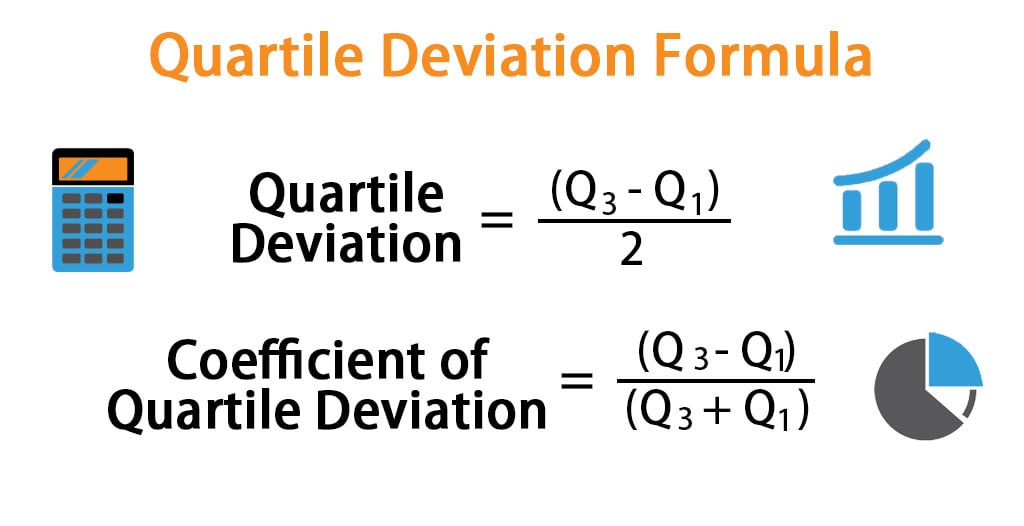

Quartile Deviation Formula Calculator Examples With Excel Template

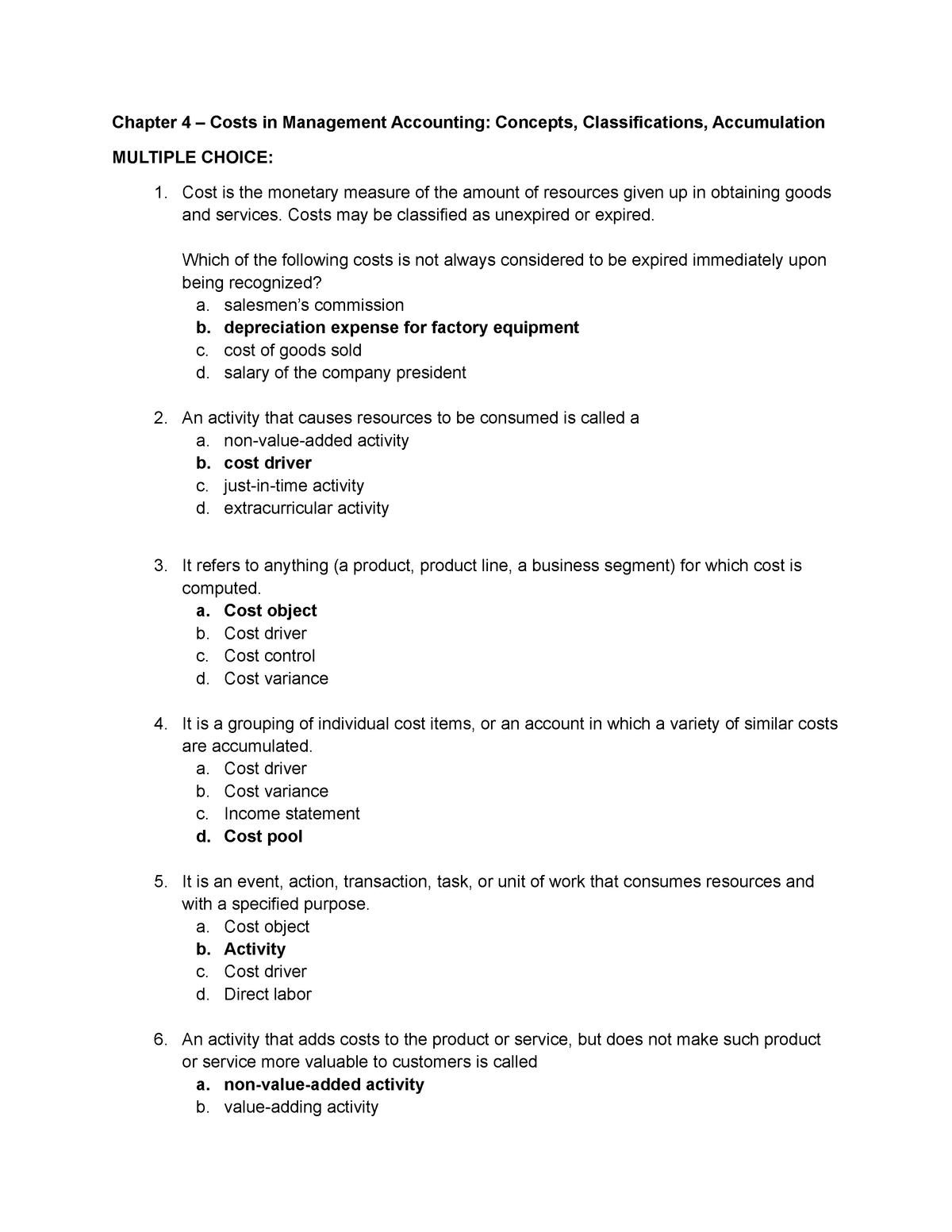

Chapter 4 Roque Chapter 4 Costs In Management Accounting Concepts Classifications Studocu

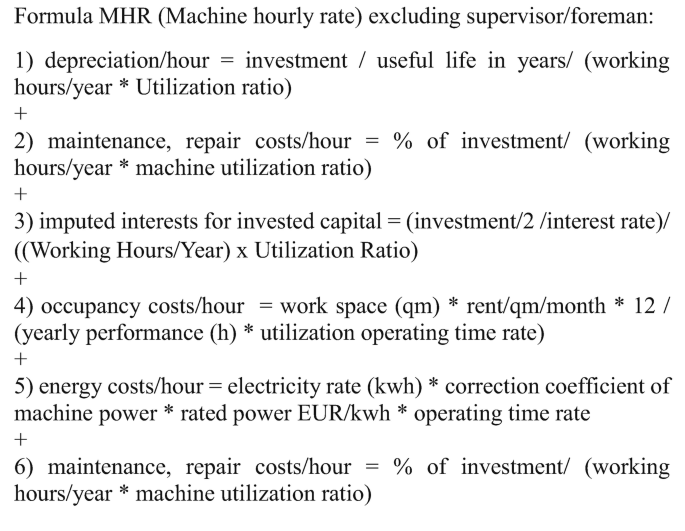

Cost Break Down And Cost Structure Analysis Springerlink

Guide To Net Sales And Cost Of Sales Freshsales

Fixed Cost Formula Calculator Examples With Excel Template

Guide To Net Sales And Cost Of Sales Freshsales

Present Value Factor Formula Calculator Excel Template

Guide To Net Sales And Cost Of Sales Freshsales

Question No 19 Chapter No 12 D K Goal 11 Class Tutor S Tips

Fixed Cost Formula Calculator Examples With Excel Template

Fixed Cost Formula Calculator Examples With Excel Template